SAP® Monetary Accounting (FI) collects and stores business transactions in a means that satisfies external reporting requirements. This course is out there on the BSc in Business Mathematics and Statistics, BSc in Administration, BSc in Statistics with Finance and Diploma in Accounting and Finance. And you might want to anticipate the impression of key enterprise decisions on your accounting and financial reporting.

This certificate is the best – though not obligatory – prerequisite for the qualification to SAP Licensed Skilled in Financial Accounting. In other words, the balance sheet is a monetary snapshot at a specific cut-off date. I am now in a position to read stability sheet, earnings assertion and case stream of any firm and might make choices.

Accounting ideas This free online course covers basic accounting ideas and ideas, the connection betwen them. In the U.S., the Financial Accounting Standards Board (FASB) establishes monetary accounting and reporting requirements (usually accepted accounting rules, or GAAP).

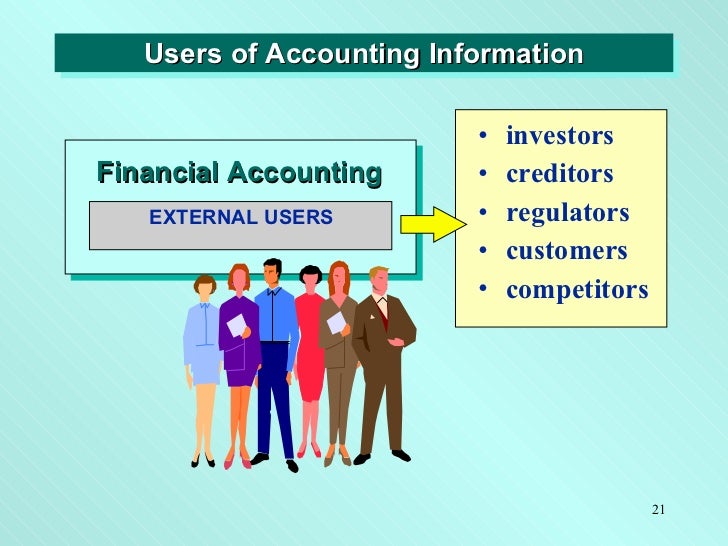

Monetary reporting occurs via using financial statements. In financial accounting, price classification based mostly on sort of transactions, e.g. salaries, repairs, insurance, stores etc. Offering info to the users for rational choice-making: accounting as a ‘language of enterprise’ communicates the financial result of an enterprise to various stakeholders via financial statements.

On this second module of this free accounting course, we explore the structure of the money move assertion, clarify the differences between the cash flow statement and the revenue assertion, and prepare a money flow statement from scratch.