The Select Group, in addition to adhering to socially responsible lending practices, also encourages prudent credit use by its shoppers. Routinely flags customers with deteriorating credit score metrics to analysts for in-depth evaluation. By clarifying who the actual customer is in the preliminary phases of the provision, the enterprise can more effectively enforce the gathering of outstanding payments if the customer had been to enter default.

Hokas is an application to your accounting system with automated accounts receivable administration and collections. Making use of monetary relations administration (FRM) in step with customer relations administration (CRM) and firm objectives. An accepted credit administration policy can offer assurances to a financing bank, which can facilitate financing.

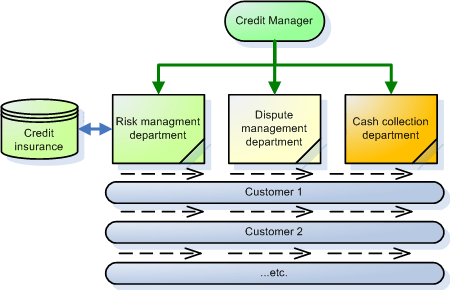

Managers may develop credit standing standards, define credit score ceilings and oversee credit score assortment accounts. That means, if your revenue will increase significantly over the lifetime of the loan (20-25 years), your payments will proceed to develop. We’ve used the services of ACT Credit Administration for the last ten years for each our debt collection work and onward legal instances.

However, an accountant or financial supervisor care more of the cash position and the chance to grant a credit score to an insolvent consumer. By utilizing our credit management solution, you can rapidly reduce days gross sales outstanding (DSO) and speed up payment timetables, maintaining a wholesome cash circulation as you use and increase what you are promoting.

Credit managers may be found working in banks, bank card firms, credit unions, investment firms or in non-monetary institutions that deal with shopper credit or investments, equivalent to firms, universities and hospitals. Carried out effectively, credit administration promotes prompt customer cost, improves cash move and reduces the danger of bad debt.